by phillipgilbertlaw.com | Oct 5, 2023

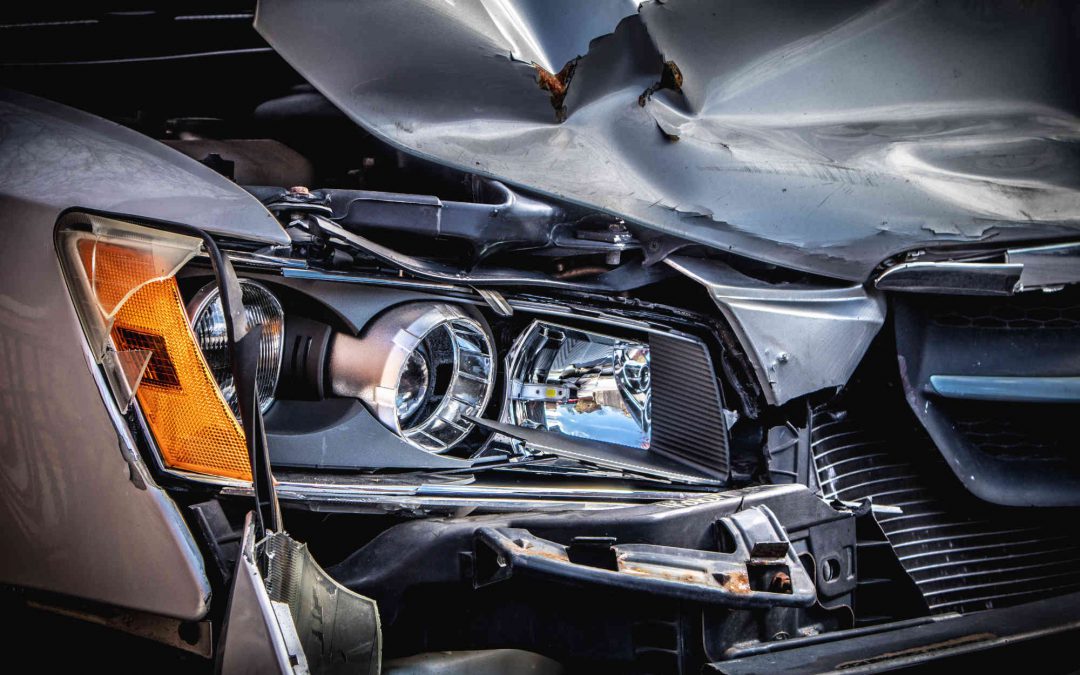

According to the Gresham Police Department, there were 126 reported auto vehicle collisions in the Gresham area in September 2023. Of these collisions, 57 resulted in injuries, including 13 serious injuries. The most common type of collision was rear-end collisions,...

by phillipgilbertlaw.com | Mar 11, 2023

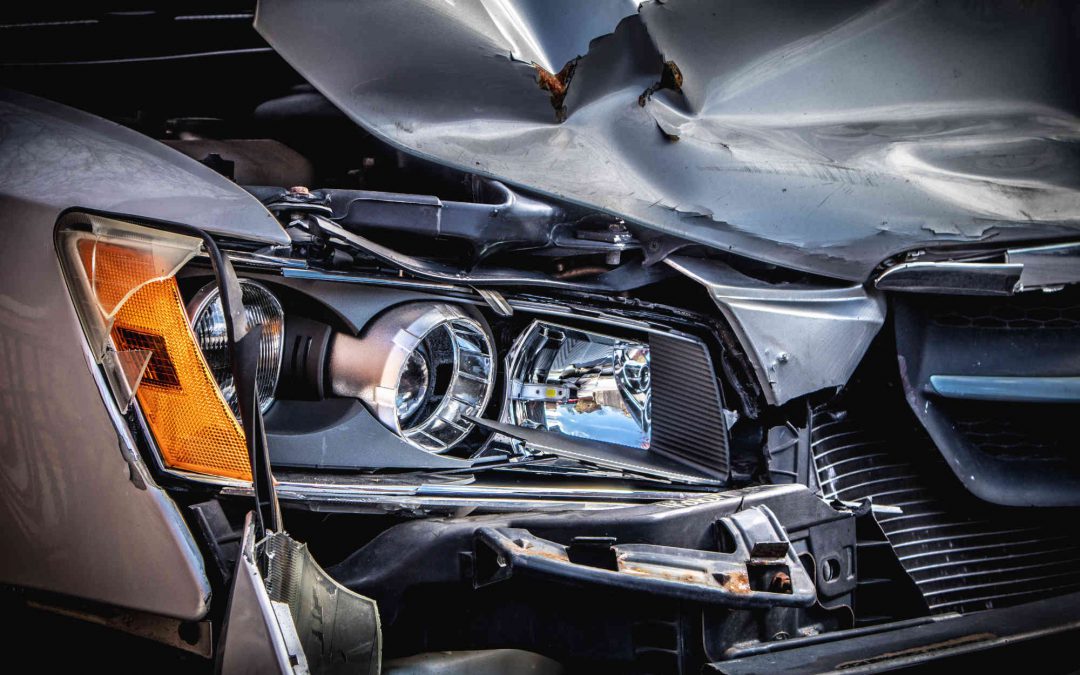

Not infrequently, people who contact our firm about an injury car accident or truck accident that they were recently involved in, ask us whether or not they should wait to hire an attorney. With very limited exceptions, our strong recommendation is to hire an attorney...

by phillipgilbertlaw.com | Dec 26, 2022

What Is a “Statute of Limitation”? Particularly if you are not represented by an attorney, it is extremely important that you understand that there are statutes of limitations that apply to any kind of civil claim that someone may want to assert against another person...

by phillipgilbertlaw.com | Dec 20, 2022

Source: City of Portland, Oregon Bureau of Transportation Portland’s highest-crash streets and intersections in low-income communities and communities of color receive priority for investments in safety. On this page High Crash Network Streets High Crash Network...

by phillipgilbertlaw.com | Dec 17, 2022

Source: Electronic Frontier Foundation Automated license plate readers (ALPRs) are high-speed, computer-controlled camera systems that are typically mounted on street poles, streetlights, highway overpasses, mobile trailers, or attached to police squad cars. ALPRs...

by phillipgilbertlaw.com | Dec 16, 2022

Ellen Rosenblum, Oregon’s attorney general, announced a nearly $700 million settlement Thursday with the biotech giant Monsanto for its alleged role in polluting the state over the course of decades with toxic compounds known as polychlorinated biphenyls, or PCBs....

by phillipgilbertlaw.com | Dec 16, 2022

The Consumer Product Safety Commission recently re-announced the recall of 321,160 Generac and DR 6500-watt and 8000-watt portable generators sold in the United States, and another 4,575 sold in Canada. This second recall came in the wake of a finger amputation and...

by phillipgilbertlaw.com | Apr 14, 2021

We’re often asked by our clients what they should have done after having been involved in the accident (the term “accident” is actually a misnomer, as is discussed in a previous blog post). In some respects, the answer to that question depends on the nature of the...

by phillipgilbertlaw.com | Jan 31, 2021

It goes without saying that the term “car accident” (and the related terms “auto accident” and “motor vehicle accident”) are commonly used to describe vehicle collisions1 that produce injuries to one or more of the vehicle occupants...

by phillipgilbertlaw.com | Jan 1, 2021

What exactly is a “personal injury” claim, you may ask. Generally speaking, a personal injury claim is a claim wherein someone seeks reasonable compensation (in the American legal system, the types of compensation that can be recovered are referred to as “damages”)...